Mutual funds have been, and arguably still are, a convenient option for investing with the aim of growing your wealth. You can consult with a bank’s financial advisor or use their brokerage services, where after answering some questions, they will create a portfolio tailored to your age and risk tolerance.

Why are mutual funds a bad investment?

Mutual fund fees can be quite high. Granted, you’re paying for a service (advisor) and your bank may follow up in a year to go over your investment portfolio and risk profile.

These fees are not paid up front, but paid out of your returns. The Management Expense Ratio (MER) is the cost to run the fund. Some funds can easily charge you over 2% so when your money grows, their fees grow! Note, higher fees do not correlate to better returns!

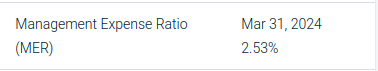

In the example below, you can see, that the specific fund is charging a fee of 2.53%. This fee will be “paid” regardless of fund performance.

With every $100 you’re essentially paying $2.53 on a yearly basis. Sure it doesn’t sound like a lot of money but when investing $1000 it’s $25.30 at $10000 it’s $253!

These fees can vary depending on the complexity of the fund and how actively managed it is.

What is the alternative?

Great news! There’s an alternative called an ETF, or Exchange Traded Fund. An ETF consists of a collection of assets (stocks, bonds, etc) similar to a mutual fund, but often with a significantly lower MER.

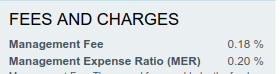

In the example below, you can see the MER of the popular iShares Core Equity ETF Portfolio, XEQT, that it charges a small management fee of 0.2%

On $1000 investment, it will cost you $2, on $10000 it will cost you $20.

ETFs usually require you to have a investment (stock) account which most banks offer. Some banks do not charge you transaction fees, if you purchase their own ETF offerings.

If you’re in Canada, great news, you can open an account with WealthSimple which does not charge fees on purchasing stocks or ETFs. If you do not want to do any of the work, they offer an ETF that they automatically manages its fund with a small MER fee.

Is there more work to do?

Regardless if you choose a mutual fund or an ETF, you should be reading a bit into what your financial advisor/planner is suggesting. The product might not be a good fit for you.

Similar to mutual funds, ETFs offer the advantage of not needing to buy numerous individual stocks to achieve a diversified portfolio. You can create a well-balanced portfolio with just 4-5 ETFs!